Financial Independence in Retirement

When people set their retirement goals what they are really looking to achieve is financial independence. In a day when we are living longer and healthier lives, retirement is no longer a necessity for most of us (meaning we are still healthy enough to work at the age of 65), it is an objective. Retirement now means reaching a point in one's life when you wish to have the financial independence to operate on a daily basis the way you choose without doing a job that is tied to your income.

There is a spectrum of financial independence and, for most of us, it takes time to rachieve true independence.

- At one end of the spectrum, you are completely dependent upon others for your financial security. As a child, for instance, you’re dependent on your parents for support

- When you no longer need financial support from your family, you achieve one degree of financial freedom. You still might be dependent upon other creditors (your bank, your credit card company), but these are companies and not people.

- When you break free from the chains of consumer debt, you achieve another degree of financial freedom.

- Further along the continuum, you achieve greater freedom when you do things like eliminate your mortgage or have enough money saved that you’re no longer glued to your job.

- At the far end of the spectrum is complete financial independence. Here, you have enough in savings that you could fund your lifestyle for the rest of your life.

How much do you need to achieve full financial independence? The answer depends on the assumptions you make about inflation, investment returns, your lifespan, and so on.

Over the past 20 years, we have assisted many clients through the transition from a working career into retirement. We analyze each client's retirement picture and develop a plan of action that evaluates pensions, 401(k) plans, savings, stock options, deferred compensation, and other assets to structure a retirement income stream.

Whether you’re in the prime of your career, just a few years away from retirement, or already evaluating an early retirement offer, we can help create an investment plan that meets your independence goals.

Our customized evaluation determines when you can safely retire, at what level of income, adjusted for inflation, and what rate of return will be necessary to meet your retirement goals.

We offer specialized advice on:

- Creating income streams from retirement assets

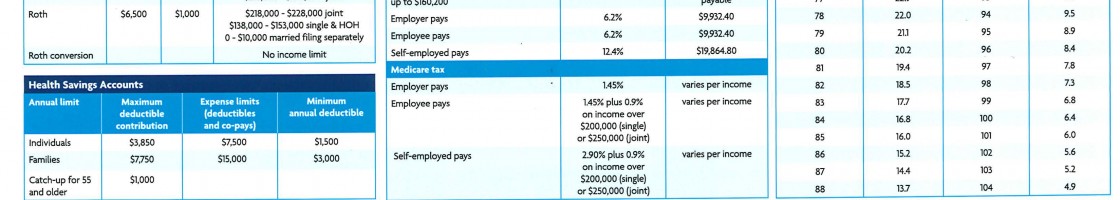

- Setting up and funding self-directed IRAs and other retirement plans for individuals and small businesses

- IRA rollovers

- Roth IRA conversions

- Selecting investments in retirement plans

Learn More About your Path to Financial Independence and where you fall in the Independence Spectrum by making an appointment with Summit Portfolio Management.