College Funding

529 college savings plans

|

Pros |

|

|

Unlimited participation |

Anyone - parent, grandparent, or friend - can own an account for a beneficiary. Some plans allow only the account owner to contribute. |

|

No income restrictions |

Invest in a plan, no matter how much you earn. |

|

Flexible age limit |

Most plans allow contributions for a beneficiary of any age. Only a few plans have age restrictions. |

|

High contribution limit |

Contributions can be made for a beneficiary until total assets for that beneficiary reach from $200,000 to $300,000 or more, depending on the sponsoring state. |

|

State income tax deductibility |

Contributions to your state's plan may be eligible for a total or partial deduction on your state income tax return. |

|

Investment flexibility |

Generally, you can choose between two types of investments: age-based options (the provider adjusts your investments to a more conservative mix as your child nears college) and individual investments (you develop and manage your strategy). You can exchange among investments within the plan once each calendar year or roll over your assets to another state's plan once every 12 months. |

|

Ability to change beneficiary |

Transfer the account at any time to a different beneficiary who is an eligible family member of the original beneficiary. |

|

Tax-free withdrawals |

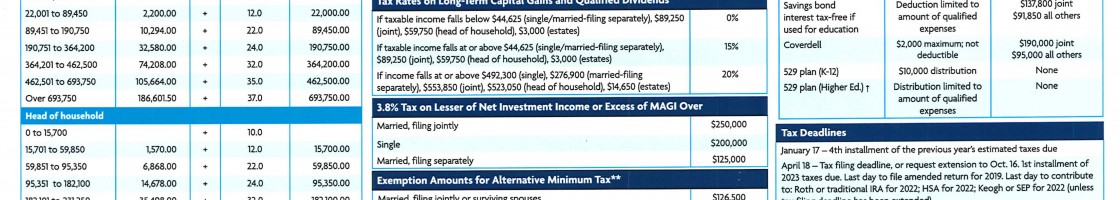

The account grows tax-free. Withdrawals are free from federal income tax if used to pay for qualified higher education expenses. (Earnings on nonqualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.) Withdrawals may also be free from state income tax, depending on your state's laws. |

|

Minimal impact on federal financial aid |

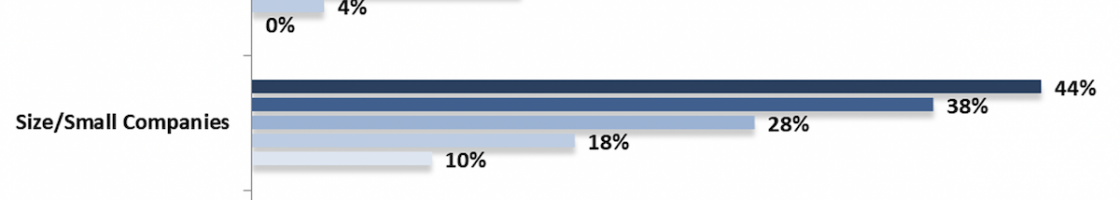

Plans are treated as parental assets for the purposes of federal financial aid and are assessed at the lower, parental rate of 5.64%. |

|

Accelerated gift-tax benefit |

You can contribute up to $60,000 in a single year (five times the normal exclusion of $13,000 per year) for each beneficiary without incurring the federal gift tax as long as you don't make any other contributions or gifts to that beneficiary for four more years. Married persons filing jointly can contribute up to $120,000 in a single year without being subject to the gift tax. If you choose to take advantage of the accelerated gift-tax benefit and you die within five years, a prorated portion of the contribution will be subject to estate tax. If you contribute more than $12,000 in a particular year, you must file IRS Form 709 by April 15 of the following year. For more information, consult your tax advisor or estate-planning attorney. |

|

Reduced estate tax |

Generally, the account value isn't included in anyone's estate for tax purposes. |

Education savings accounts

For children under age 18, education savings accounts (ESAs) allow a total contribution of $2,000 a year from all sources. Although your contributions to an ESA aren't tax-deductible, earnings grow federally tax-deferred. Generally, you can invest in anything except insurance policies.

Money can be withdrawn from the account tax-exempt for qualified elementary, secondary, college, and graduate school expenses, such as tuition, room and board, books, and supplies. Most financial institutions and mutual fund companies offer ESAs. Like IRAs, you can contribute to an ESA for a particular tax year until April 15 of the following year.

Education savings accounts

|

Pros |

|

|

Unlimited contribution sources |

Although only the parent or legal guardian can own the account, anyone - parent, grandparent, friend, or the beneficiary - can |

|

Investment flexibility |

Generally, you can invest in all types of securities, except insurance policies. |

|

Ability to change beneficiary |

Assets can be rolled over to an ESA or 529 college savings plan for an eligible family member of the original beneficiary. This transfer is tax-free at the federal level. |

|

Flexible tax-free withdrawals |

The account grows tax-free. Withdrawals are free from federal (and sometimes state) income tax when used to pay for qualified education expenses at any level - primary, secondary, college, or graduate school. |

|

Minimal impact on federal financial aid |

ESAs are treated as parental assets for the purposes of federal financial aid and are assessed at the lower, parental rate of 5.64%. |

|

Reduced estate tax |

Generally, the account value generally isn't included in anyone's estate for tax purposes. |

|

Cons |

|

|

Contribution limit |

Total annual contributions from all sources and to all accounts for the same beneficiary can't exceed $2,000 a year. |

|

Income restrictions |

The amount a person can contribute is reduced and gradually phased out for a modified adjusted gross income between $95,000 and $110,000 if single, or between $190,000 and $220,000 if married and filing jointly. |

|

Inflexible age limit |

Contributions can be made only until the beneficiary reaches age 18, unless he or she is a beneficiary with special needs. Tax-free and penalty-free withdrawals are available only for as long as the beneficiary is under age 30. |

|

Investment risk |

Most of the investment choices aren't FDIC-insured or government-guaranteed, and, depending on the investment, may be subject to market, interest rate, and other financial risks. |

|

Penalty if not used for education |

Earnings on withdrawals not used for education are taxed at the account owner’s federal tax rate and usually incur a 10% federal penalty tax. |

UGMA/UTMA accounts

Uniform Gifts to Minors Act/Uniform Transfers to Minors Act accounts offer a convenient way to make tax-exempt gifts that can be used to pay for college.* Contributions are irrevocable - ownership can't be changed or transferred to another beneficiary.

These accounts are established for a minor but are administered by an adult custodian who can only use the assets for the child's benefit. The beneficiary takes control of the account when he or she reaches the age of majority (generally ages 18 to 21) according to the laws of the state in which the account is established.

In general, states offer only one of these account types - primarily the UTMA - so consult your financial advisor to learn which type your state provides and to review the guidelines for determining the age at which the beneficiary takes control of the account. You can open an account through most mutual fund companies, banks, and brokerages.

If you're the custodian of an UGMA/UTMA account, you may elect to transfer all or a portion of those assets to a 529 college savings plan account. You should be aware that the UGMA/UTMA rules of the state in which the account was established will apply to those assets and any future contributions to the 529 account. In most situations, it would be best to either leave the funds in the UGMA/UTMA account or open separate 529 accounts: one funded with UGMA/UTMA assets and another funded with cash contributions. For more information, consult your tax advisor.

* The recipient of the gift will have to pay taxes on earnings and withdrawals.

UGMA/UTMA accounts

|

Pros |

|

|

Unlimited participation |

Anyone - parent, grandparent, or friend - can contribute for a beneficiary. |

|

No income restrictions |

You can invest in an account no matter what you earn. |

|

No contribution limit |

There's no limit to the amount that can be contributed. Individuals can invest up to $13,000 a year ($26,000 if giving with a spouse and filing a joint tax return) without incurring the federal gift tax. |

|

Investment flexibility |

You can choose from a wide selection of marketable securities and bank products. Some states' UTMA accounts allow noncash gifts such as appreciated securities or real estate. |

|

No penalty if not used for college |

The custodian can use the account assets for any purpose that benefits the child, excluding parental obligations such as food, clothing, and shelter. |

|

Not taxable to donor |

Any income or capital gains generated by an UGMA/UTMA account are taxed to the beneficiary, not to the donor. |

|

Cons |

|

|

Irrevocability |

Once established, an UGMA/UTMA account is irrevocable - ownership can't be changed or transferred to another beneficiary. |

|

Beneficiary gains control of assets |

Upon reaching the age of majority, the beneficiary can use the assets for any purpose - educational or otherwise. |

|

Investment risk |

Most of the investment choices aren't FDIC-insured or otherwise government-guaranteed and, depending on the investment, may be subject to market, interest rate, and other financial risks. |

|

Taxable earnings |

Contributions are not tax-deductible, and earnings are subject to federal income or capital gains tax. Special "kiddie tax" rules apply to investment income (dividends and interest) earned within the account. If the child's earned income does not exceed half the amount of his or her support, the first $900 of investment income received in a single year for a child who is under age 19 or a full-time student under age 24 is not taxable. The second $900 of income is taxed at the child's tax rate, and anything above $1,800 in income is taxed at the parents' tax rate. Once the beneficiary reaches age 19, or is no longer a full-time student under age 24, all income earnings are taxed at the beneficiary's rate. |

|

Significant impact on federal financial aid |

Account is treated as the child's asset for purposes of federal financial aid and is assessed at the higher child rate of 20%. |

|

Impact on estate tax |

Assets may be included in the donor's or parent's estate until the beneficiary has reached the age of majority. |

Individual mutual funds

When used for college savings, mutual funds offer great flexibility. You can save as much as you want and make withdrawals whenever you want. And, your mutual fund assets have minimal impact on any financial aid for which your student may be eligible.

Of course, you will have to pay taxes on any taxable distributions the fund makes and on any capital appreciation when you sell fund shares. Because of this, most investors should choose tax-managed funds, which seek to minimize taxes.

Individual mutual funds

|

Pros |

|

|

Investment flexibility |

Choose from a wide variety of stock, bond, balanced, and short-term investments. |

|

No penalty if not used for college |

Account assets can be used for any purpose. |

|

No contribution limit |

There is no limit on the amount that can be contributed. |

|

Minimal impact on federal financial aid |

Mutual funds are treated as parental assets for the purposes of federal financial aid and are assessed at the lower, parental rate of 5.64%. |

|

Cons |

|

|

No special tax treatment for college savers |

Earnings and capital gains are taxed at the owner's marginal rate. Consider using tax-exempt, index, and tax-managed mutual funds to minimize the impact of income taxes on your funds' returns. |

|

Impact on estate tax |

Assets are included in the owner's estate. |

|

No state income tax deductibility |

Contributions are not deductible on state income taxes. |

|

Investment risk |

Mutual funds are not FDIC-insured or otherwise government-guaranteed and are subject to market risk. Investments in bond funds are subject to interest rate, credit, and inflation risk. |

529 prepaid tuition plans

Sponsored by the states - and by a group of independent colleges and universities across the United States - 529 prepaid tuition plans allow you to lock in tuition rates for future education costs.

Using after-tax money, you purchase education contracts (a specified number of semesters or years of tuition) or units (a fixed percentage of tuition) for future use. You can contribute by a single lump sum or through installment payments. To be more competitive with 529 college savings plans, some 529 prepaid tuition plans may also offer you the option to invest in a limited selection of mutual funds.

When your child is ready to enroll in college, you can redeem the contracts or units to pay for qualified higher education expenses (generally, tuition and fees only). Like 529 college savings plans, earnings on prepaid tuition plans are exempt from federal income tax if used to pay for qualified higher education expenses. Many states offer tax-deductible contributions for residents.

529 prepaid tuition plans

|

Pros |

|

|

No income restrictions |

You can invest in a plan no matter how much you earn. |

|

Contribution certainty |

By buying prepaid tuition contracts or units, you lock in future tuition costs. The purchase price depends on the age of the beneficiary and on whether the payment is by lump sum or installment. |

|

State income tax deductibility |

If you invest in your state's plan, you may be able to deduct some or all of your contributions on your state income tax return, depending on your state's laws. |

|

Ability to change beneficiary |

The account can be transferred at any time to a beneficiary who is an eligible family member of the original beneficiary. |

|

Tax-free withdrawals |

The account grows tax-free. Withdrawals are free from federal income tax if used to pay for qualified higher education expenses. (Earnings on nonqualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.) Withdrawals may also be free from state income tax if you invest in your state's plan. |

|

Minimal impact on federal financial aid |

Plans are treated as parental assets for the purposes of federal financial aid and are assessed at the lower, parental rate of 5.64%. The refund value is the amount of money you would receive if you were to cash out your prepaid tuition account. For example, if you have saved in a prepaid tuition account in your home state to attend college in another state, you may be able to withdraw an amount (the refund value) from that account to be used to pay tuition in that other state. |

|

Accelerated gift-tax benefit |

You can contribute up to $60,000 in a single year (five times the normal exclusion of $13,000 per year) for each beneficiary without incurring the federal gift tax, as long as you don’t make any other contributions or gifts to that beneficiary for four more years. Married persons filing jointly can contribute up to $120,000 in a single year without being subject to gift tax. If you choose to take advantage of the accelerated gift-tax benefit and you die within five years, a prorated portion of the contribution will be subject to estate tax. If you contribute more than $12,000 in a particular year, you must file IRS Form 709 by April 15 of the following year. For more information, consult your tax advisor or estate planning attorney. |

|

Reduced estate tax |

Generally, the account value is not included in anyone's estate for tax purposes. |

|

Cons |

|

|

Limited tax-free withdrawals |

Many plans permit withdrawals only to pay tuition and fees; they do not allow use for room and board. |

|

Limited participation |

Many plans require the owner to be a resident of the state that offers the plan; some plans require the beneficiary to be a state resident. |

|

Age limit |

Many plans include a time limit for withdrawals based on the date the beneficiary is likely to graduate from high school or enter college. |

|

Limited investment options |

Plans generally offer investments that match the tuition inflation rate. |

|

Investment risk |

Plans are not FDIC-insured or otherwise government-guaranteed. |

|

Potentially high expenses |

Some plans charge high fees, including broker commissions and enrollment, annual maintenance and transfer fees. |

|

Penalty if not used for college |

Earnings on withdrawals not used for higher education are taxed at the recipient's federal tax rate and usually incur a 10% federal penalty tax. |

U.S. savings bonds

Two types of savings bonds - Series EE bonds and Series I bonds - offer special incentives to college savers.

Series EE bonds are bought at a discount to the face amount and accrue until they reach full face value; even after they mature, they earn interest for 30 years.

Series I bonds are purchased at full face amount but accrue at two rates of return over their 30-year life: a fixed rate and a variable rate that's adjusted twice a year for inflation.

For both types of bonds, principal is guaranteed, and the interest earned may be completely or partially excluded from federal income tax when used to pay for qualified higher education expenses of a dependent. The accrual amount is also exempt from state and local income taxes even if you decide not to use the money for education expenses. You can purchase U.S. savings bonds issued in a variety of denominations from $50 to $10,000 through the federal government and most banks and brokers.

To qualify for the federal income tax exclusion on U.S. savings bonds used for higher education, you as the bond owner must use the proceeds to pay for the qualified expenses of yourself, your spouse, or an individual you can legally claim as a dependent on your tax return. If you are a grandparent or friend of the beneficiary, you generally will be unable to claim the exclusion. For more information, refer to IRS Publication 970.

U.S. savings bonds

|

Pros |

|

|

Unlimited participation |

Anyone - parent, grandparent, or friend - can purchase bonds for a beneficiary. However, to qualify for withdrawals free from federal income tax, you must be at least 24 years old and the bonds must be used for yourself, your spouse, or your child. |

|

Low risk |

The bonds are government-guaranteed. |

|

No fees or expenses |

There is no cost to purchase the bonds if you buy them directly from the federal government or a bank. |

|

High contribution limit |

Individuals can purchase up to $30,000 ($60,000 if married and filing jointly) of each type of bond per year. |

|

Ability to change beneficiary |

You can change the beneficiary to anyone at any time for any reason. |

|

Tax-free withdrawals |

Earnings grow tax-deferred and are exempt from state and local income tax. Withdrawals may be free from federal income tax if used to pay for qualified higher education expenses for a dependent (see "Tax-free withdrawal restrictions" under "Cons" below). |

|

No penalty if not used for college |

You can redeem the bonds for any reason from 1 to 30 years after purchase. Bonds issued prior to February 2003 are eligible for redemption six months after purchase. |

|

Minimal impact on federal financial aid |

Savings bonds are treated as parental assets for the purposes of federal financial aid and are assessed at the lower, parental rate of 5.64%. |

|

Cons |

|

|

No investment flexibility |

You invest in savings bonds only. |

|

Tax-free withdrawal restrictions |

To qualify for withdrawals free from federal income tax, you must be at least 24 years old when you buy the bond, and the bond must be used for yourself, your spouse, or another dependent. The amount you can withdraw free from federal income tax for a dependent is reduced and gradually phased out for a modified adjusted gross income for 2006 between $63,100 and $78,100 if single, or between $94,700 and $124,700 if married and filing jointly. Also, unlike with other savings options, the costs of books and room and board aren't considered to be qualified expenses. |

|

Early redemption penalty |

You can redeem the bonds a year after purchase. However, you will forfeit three months of interest if you redeem the bonds in the first five years. |