Investment Portfolio Analysis

A portfolio analysis is a useful tool in evaluating how your investment portfolio is performing in terms of rate of return and risk. Accomplished by looking not only at how your individual investments perform but also how they perform together, an analysis can identify underperforming or excessively risky assets and provide guidance as to where changes to your investment allocations should be made to keep you on track to meet your investment objectives. Although each individual investor has his own goals in terms of performance, a routine analysis can be useful for any portfolio regardless of its strategy.

We offer a comprehensive investment portfolio analysis for those interested in improving the structure, allocation and tax management of their portfolio. Often, we provide this type of consultative advisement to those who aren't quite ready to delegate their investment management to an advisor. This provides an in-depth analysis of your current holdings and recommendations for improving your portfolio. This service includes:

-

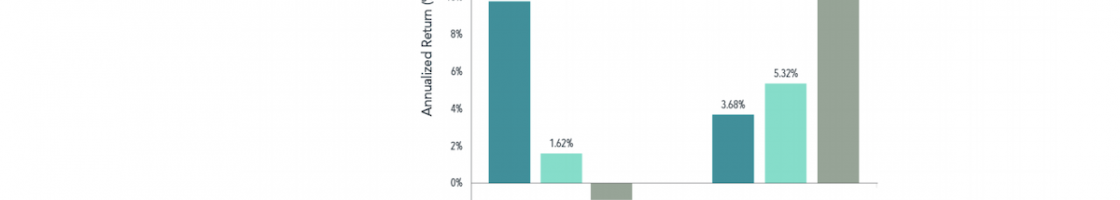

Statistical analysis:

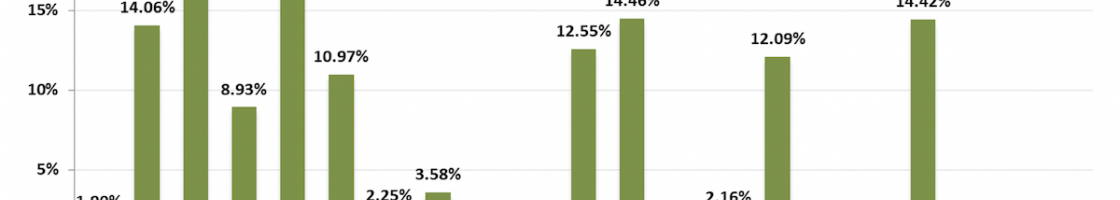

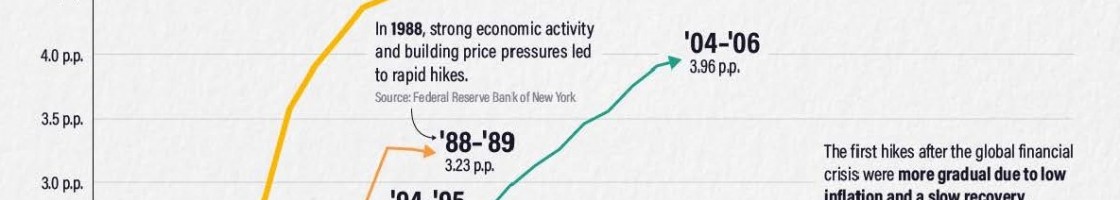

historical returns, expected returns, risk/return analysis, multi-factor regressions.

-

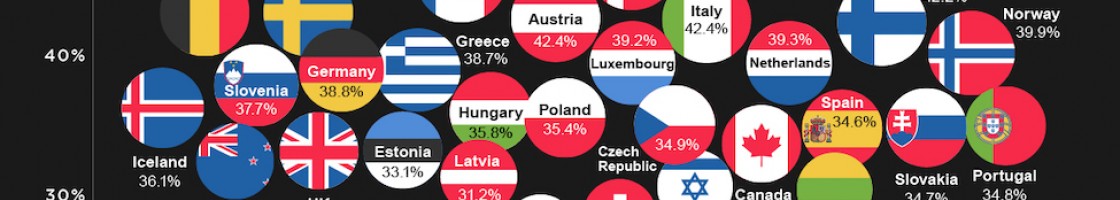

Diversification risks:

Equity securities; sectors, industries, country exposures, overlapping positions, comparative benchmarks. Fixed income securities: maturities, credit, currency exposures, and comparative benchmarks.

-

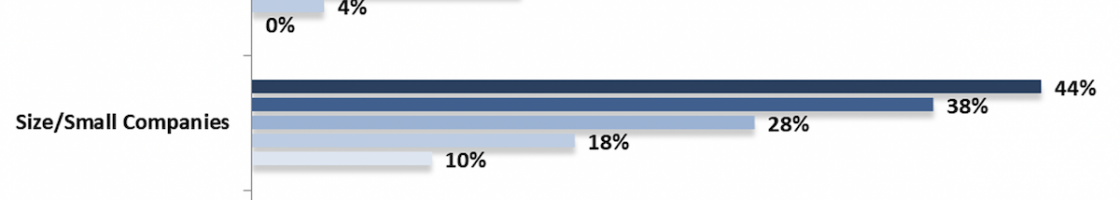

Equity factor analysis:

Company size and price/book exposure; comparative benchmarks.

-

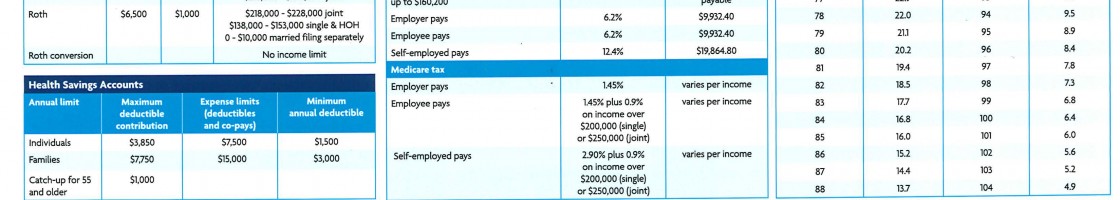

Money manager or mutual fund analysis:

Same factors as above - plus; track record and value-added analysis, expenses, tax efficiency and benchmarks.

-

Client education. Do you Know where your returns come from?

Provide clients and potential clients insight into how they might improve the performance of their portfolio, minimize their exposure to risk and better align their investments with their goals.

Complete THIS FORM TO SCHEDULE YOUR PORTFOLIO ANALYSIS TODAY!

No fee is charged for an initial consultation.