Our Story

Summit Portfolio Management is an independent financial advisory firm located in Las Vegas, Nevada that provides financial advice based on Nobel Prize winning research. We are a fee-only wealth management consulting firm that represents the interests of high net worth individuals, fiduciaries of qualified plans and trusts. Our advisory service differs significantly from most financial services firms. As a fiduciary we are legally bound to provide objective advice and a broader range of financial options without the conflicts of interest commonly associated with investment product purveyors or traditional investment advisory firms.

Founded in 1984 by Timothy F. Bock, Summit takes pride in providing state-of-the-art financial planning strategies, investment portfolio construction and management, and portfolio analysis. Summit is one of the few firms nationwide to provide “Portfolio Engineering.” Portfolio Engineering is the process of linking clients’ financial objectives to a portfolio strategy designed to have the highest probability of success.

We are committed to the highest standards of service, integrity, quality, and excellence.

The Fiduciary Advantage

The most important investment decision you can make is who to trust to best invest and manage your life savings. In order to understand the importance of this question, investors must understand the significant difference between traditional stock brokers and Registered Investment Advisors, (RIAs).

By law, RIAs have a fiduciary obligation to act in the best interest of their client and provide full documented disclosure of any potential conflicts of interest. The stock broker has no legal obligation to ensure the customer’s best interest.

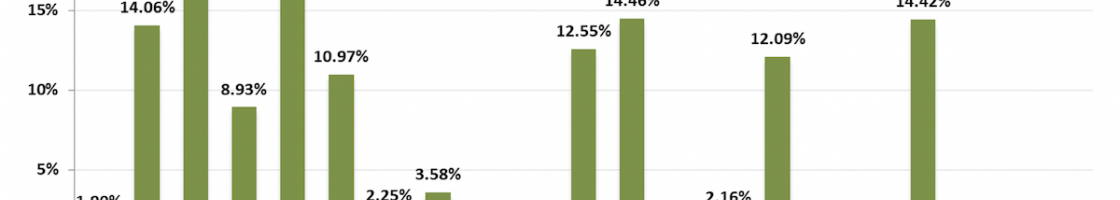

According to the S.E.C., 99% of all investors’ complaints are made against commissioned brokers, versus only 1% of RIAs. The compensation source is key to who you should trust with your money. Registered Investment Advisors that are compensated solely by fee for services eliminates the sales or trading incentives conflicts.

“Independent, impartial advice is key to act in the best interest of the client. Which would you choose?”